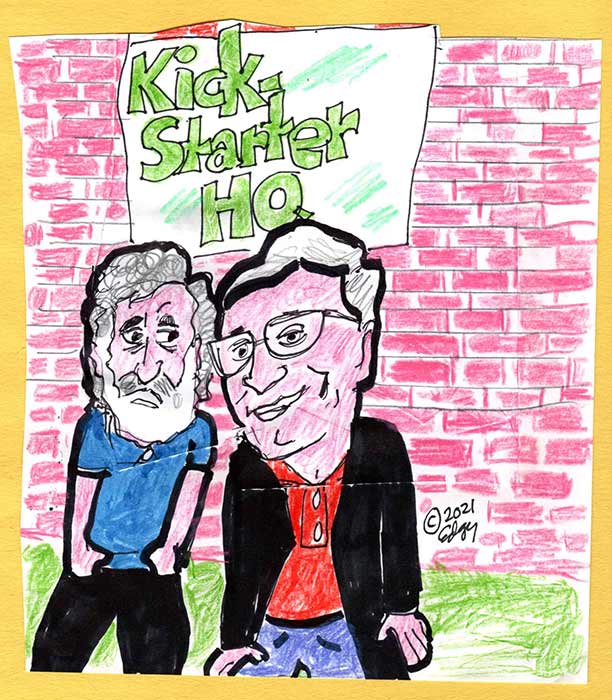

Gates vs. Gates: O, How the Mighty Are All-in

Greek tragedy-made-real for millions of non-theatregoers

By Ed Goldman

Any of you who grew up watching Greek tragedies must relate to this sordid story and be really, really old. (Wait. I guess you could have watched more recent stagings than the original productions, so please disregard the part about your being really, really old.)

Overdo Bill

Anyway, no matter how the protagonist scores the dough, he’s well-fixed and needn’t even think of taking out a second on the Parthenon. But the protagonists in these plays always have a tragic flaw: “hubris.” This pretty much means vainglorious pride in Greek. (In Yiddish, it’s an inquiry by a rabbi looking for the home where he’s supposed to supervise a circumcision.)

While the characters in Greek tragedies were wealthy fops, audience members consisted of regular folks: they might have been called blue-toga workers, though I’m double-checking on that. Regardless, even though theatregoers seemingly couldn’t identify with the people on stage, the mission of the plays was to provide “catharsis” to the audience members. This can be defined as a cleansing or purification—as in, “Thank the gods I’m not as nutty as this guy in the play who married his mother and moved with her into an Oedipus complex in midtown.” In short, catharsis is meant to make us feel better about ourselves.

Gates vs. Gates may end up having the same effect. For while most of us can’t easily identify with a couple who could buy an entire planet as their second home, most of us understand or have experienced marital discord, albeit with fewer zeroes attached to the settlement.

If the scuttlebutt is to be believed—and in my world, one always believes the scuttlebutt, mainly because it’s such a cute word—Bill Gates has behaved in a somewhat porcine manner, cheating on and lying to Melinda Gates even as she pushed her husband into becoming one of the greatest philanthropists who ever trod the earth. That’s how it looks from one vantage point.

Big news! Clinique is now on Amazon.

The #1 dermatologist guided skincare and makeup brand is on Amazon Premium Beauty for the first time. Shop trusted formulas across skincare, makeup, fragrance, and men’s products.

Still in all, while a divorce at certain levels of money or celebrity or both is a spectator sport, it’s rarely a cause for laughter or celebration. Unless it’s your own divorce, natch—at which time it can prove downright cathartic.

Ed Goldman's column appears almost every Monday, Wednesday and Friday. A former daily columnist for the Sacramento Business Journal, as well as monthly columnist for Sacramento Magazine and Comstock’s Business Magazine, he’s the author of five books, two plays and one musical (so far).

Yes, Virginia

A Weekly Blog by Virginia Varela

President and CEO, Golden Pacific Bank

photo by Phoebe Verkouw

A SPAC, also known as a Special Purpose Acquisition Company, recently became a very popular vehicle for raising capital, especially for “fintechs” (the emerging industry that uses technology to support and enable banking and financial services).

Generally, how a SPAC works is like this: A company is formed with no commercial operations with the sole purpose of raising money through an initial public offering (IPO). SPACs eventually will use the funds to buy still another company. In the past couple of years, SPACs have attracted big investors and raised record amounts of funding.

The advantages of a SPAC are that they can be faster and more efficient than a more traditional capital-raising process. High-profile SPAC deals include Richard Branson’s Virgin Galactic, in 2019, and Pershing Square Capital Management in 2020, both raising billions of dollars.

This week, I’m proud to note that SoFi, Inc. completed its SPAC merger, successfully raising about $2.4 billion and going public. SoFi CEO Anthony Neto said of the deal, “Today marks an important step on our path toward providing an ecosystem of products, rewards and membership benefits all working together to help our members get their money right.”

Golden Pacific Bancorp is a component of the larger strategic plan by SoFi. As I wrote recently, on March 9, 2021, SoFi and Golden Pacific Bancorp announced they had entered into a definitive agreement for SoFi to acquire Golden Pacific. This proposed acquisition is a key strategic step in SoFi’s path to obtaining a national bank charter. At this time, we’re waiting for the Office of the Comptroller of the Currency (at the U.S. Treasury) and the Federal Reserve’s review of the application. If successfully approved for a national bank charter, SoFi plans to contribute $750 million in capital into the bank, and pursue its national, digital business plan while maintaining GPB’s community bank business and footprint.

It’s exciting to watch the progress and upward direction of SoFi, and I’m not alone in betting on its success. After the announcement this week that they went public, SoFi’s stock increased by more than 6%. Proving there’s spark in this SPAC!

sponsored content