A Missive From Michigan, Or: I Got A Pal In Kalamazoo

A loyal reader weighs in on public sector fees

By Ed Goldman

Some police and fire departments in Northern California are billing citizens for saving their lives, which they’d sworn to protect,” I reported in the January 31 edition of The Goldman State.

That column prompted more responses than I’d anticipated—though, to engage in eye-popping candor, I never anticipate any responses. This is in keeping with my oft-stated maxim, stolen from the oft-stolen-from Confucius, that “He who expects nothing is never disappointed.” And I never am, friends.

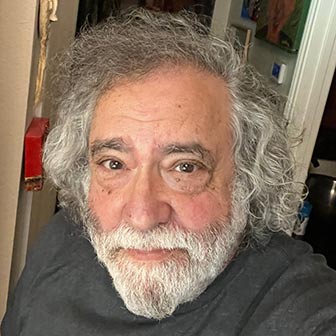

Colleen J. McBride

One of the more impassioned responses to my assertion in that column—that government departments spend every cent of their budgets each year lest they not receive that amount (and more) the following year—came from Colleen McBride, a reader in Kalamazoo, Michigan. She has also been, not incidentally, a friend of mine for more than a half century, which is probably the sole reason I have a reader in Kalamazoo.

Colleen spent more than 35 years working in the non-profit arts arena running, as she says, “city performing-arts venues, countywide arts councils and even a college foundation.” For the past decade, she’s been an arts and non-profit consultant.

I would be remiss in omitting a more dramatic factoid: When we were seniors at Lakewood High School, Colleen played Marian the Librarian to my Harold Hill (“The Music Man” himself) which explains why, after 50+ years, she still refers to me as Harold and I call her Marian in our correspondence. Here’s what she had to say:

“Another great article, Harold!

“I must apologize in advance for the rant that follows (it must be that I’m recovering from injuries inflicted by an encounter with an uplifted city sidewalk paver and my frustration dealing with city bureaucracy that I found the impulse to respond to your article was irresistible).

“I understand and relate to why you find this less than a ‘benefitting-the-public’ solution to filling gaps for government mismanagement all too familiar. As a former department head of two cities (and also a county-wide arts council and a college foundation during my career), I can tell you without hesitation that I can attest to the reality of ‘no under-budget leftovers/spend it all (and then some!)’ mantra in developing public agency budgets. It’s as if money just appears—without any acknowledgement or concern about where it comes from (that would be, of course, the pockets of taxpayers).

“I received expanded enlightenment about the state while married to my former husband, the politico, who’d worked his entire career with local and state-level governments. And I’m sure you’re already familiar with California’s long practice of ‘borrowing’ from otherwise stable budget funds in order to shore up or create other completely unrelated areas of their annual budget. Of course, it never gets paid back, leaving a deficit in the once fiscally sound line items to be filled on the backs of taxpayers (like instituting billing for essential services).

“Of course, this ‘borrowing’ shell game is nothing new. Our federal government has been doing the same thing for decades (take Social Security, for instance).

“When first introduced to this inexplicable public agency budgeting methodology while working part-time in [Long Beach] City College’s Theatre Department in my early 20’s, I was truly astonished (and aghast!), questioned the ethics of the process, and was alarmed at the ‘this is how it works’ accepted public agency budget practices response, which I repeatedly found to be true throughout my career.

“I guess I’ve become rather jaded and skeptical of my once-idealistic, cockeyed optimist belief that government agencies looked out for ‘the good of the public they serve.’ And don’t get me started on cultural facilities and of course, libraries (near and dear to my heart!).

“Thanks for indulging me. I think my blood sugar must be running low….Time to eat. —Marian”

Ed Goldman's column appears almost every Monday, Wednesday and Friday. A former daily columnist for the Sacramento Business Journal, as well as monthly columnist for Sacramento Magazine and Comstock’s Business Magazine, he’s the author of five books, two plays and one musical (so far).

Yes, Virginia

A Weekly Blog by Virginia Varela

President and CEO, Golden Pacific Bank

photo by Phoebe Verkouw

I headline this week’s blog with the Cantonese way of saying “Happy New Year.” Because two things are official: The Chinese New Year and Golden Pacific Bank’s now being a division of SoFi Bank, N.A. And you can expect the emerging bank to be stronger, more powerful, and proud. Just like the Chinese tiger.

SoFi, Inc. successfully completed the merger with Golden Pacific Bank (GPB) on the auspicious date of 2/2/22, making SoFi a nationally chartered bank. This is an incredible achievement as SoFi is one of the largest and most successful financial technology firms to successfully acquire a federally chartered bank. This impressive action is emblematic of changing times in the world of financial services. Congratulations!

SoFi Bank is now a national bank charter, while also maintaining GPB’s community bank business and footprint, including its three physical branches and GPB’s same staff. The greater Sacramento area and Yuba City communities can look forward to a wider range of products and services to choose from.

I want to go on record as saying that I’m thrilled with this development and very impressed with the foresight and strategic abilities of the SoFi leadership. Watch for more news ahead as SoFi steers ahead guided by its mission to help people achieve financial independence.

This is a great accomplishment. I’m very proud. Please join me to celebrate this great news. And GONG HEI FAT CHOY!

sponsored content