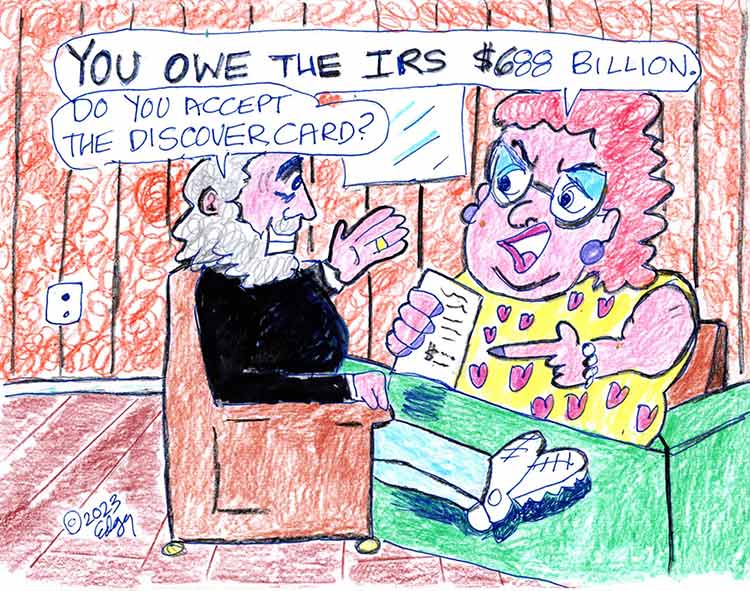

We “Failed” to Pay the IRS $688 Billion in Taxes

Question: Why is this called a failure?

By Ed Goldman

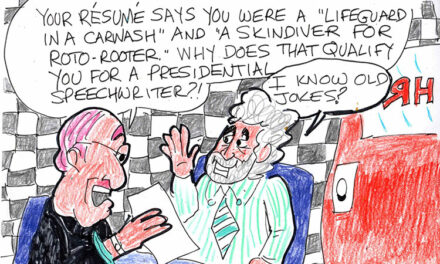

The Internal Revenue Service reported this Fall that we Americans “failed” to pay $688 billion in taxes in 2022. Let’s examine the word “failed.”

“Failed” implies that someone meant to do something but ultimately couldn’t quite pull it off. By extension (!) this implies that we Americans intended or even attempted to pay $688 billion in taxes but, in the final analysis, couldn’t or simply didn’t.

Getting down to brash tax

Maybe we’d planned to pay but left our wallet in the suit that went to the cleaners. Or an emergency cropped up just as we were about to write a check for $688 billion so had to make a split-second decision to instead renew our NetFlix account, get Taylor Swift tickets for her already sold-out 2027 concert tour or buy a solar-powered weed-whacker.

Well, I don’t think we wanted to pay in the first place. And therefore, the real story is that we succeeded in not paying $688 billion in taxes in 2021. Yay, us!

“The number reflects an increase of more than $138 billion from estimates for tax years 2017 to 2019, the agency said,” according to CBS News. “The IRS is ratcheting up audits on wealthy taxpayers (and) …wants to go after higher earners who skirt their tax obligations.”

The semi-good news is that if you make less than $400,000 a year, the agency says you won’t be in any greater peril of being audited than you were before. The semi-bad news is that you still could get audited anyway—even though (and despite) your overtime, side hustles and profitable cannabis victory garden, you still make less than $400,000 a year.

Like some, most or all of us, the fear of my being audited by the IRS is right up there with my experiencing spontaneous combustion, undergoing an emergency root canal or double-dating with Congressman Matt Gaetz (R-Neptune). The IRS helps stoke that fear by using the threat of an audit as its go-to kraken, that mythical Scandinavian sea monster which emerges from the waves, plucks sailors from their ships and drags them to watery dooms. I’m guessing sailors who chose to remain below deck—possibly after complaining they’d eaten an uncooked piece of lutefisk—are the ones who survived to tell the tale.

Just how pervasive is our fear of being audited? Two thoughts:

- A friend of mine, Bob Rubin, is a tax lawyer and former senior counsel with the IRS. He told me some years back about a woman who was terrified she’d be audited. “She said she was afraid the government would come in the middle of the night and take her lawnmower,” he said. Because Bob had a sense of humor I searched his eyes to see if he was pulling my leg. He wasn’t.

- You may be marveling at my courage for writing a column critical of the U.S. government’s taxing agency. You may be asking, “Ed, aren’t you afraid this will cause you to be audited?” Not at all. I didn’t write one word of this. It was produced in A-I by someone who hacked into my computer. He says he’ll end the hack if I pay him $688 billion “by the second Tuesday of next week.” Ha! Gotcha! Everyone knows I bowl on the second Tuesday of each week.

Ed Goldman's column appears almost every Monday, Wednesday and Friday. A former daily columnist for the Sacramento Business Journal, as well as monthly columnist for Sacramento Magazine and Comstock’s Business Magazine, he’s the author of five books, two plays and one musical (so far).

Yes, Virginia

A Weekly Blog by Virginia Varela

President, Golden Pacific Bank, a Division of SoFi Bank, N.A.

photo by Phoebe Verkouw

YOU CAN SKIP THAT SCAM (HERE’S HOW)

Whenever someone asks for your financial information, question whether they’re legitimate and why they would need it. In most cases, that’s enough to deter a would-be scammer from further targeting you.

Here’s what you can do to protect yourself from bank scams:

- Secure your online bank account with a strong password. Hackers often target your online bank account credentials through phishing emails and fake websites. Secure your account with a unique password and two-factor authentication. For extra security, use a password manager to securely store your passwords and warn you if you’re entering them on a phishing website.

- Routinely check your credit report and bank statements. If scammers gain access to your bank account, they’ll often start small to evade detection.

- Be on the lookout for the warning signs of identity theft — such as strange charges on your bank statement or accounts you don’t recognize.

- Routinely review your bank statements, credit card statements, and credit reports. Be on the lookout for unusual activities and charges that you don’t recognize.

sponsored content