The New Meaning of “Are You Now or Have Ever Been?”

Some useful etiquette tips for hirers and daters

By Ed Goldman

From around 1947 to 1958, a simple, direct and invasive question was a reliable elevator of blood pressure: “Are you now or have ever been a Communist?”

It was asked most notoriously by members of the House Unamerican Activities Committee, whose acronym, HUAC, when spoken aloud, is somewhat similar to the sound an old man makes when he expectorates chewing tobacco from his cheeks.

🎵 “It Was Vaccination, I Know…:

This doesn’t hold true for the question of one’s Commie leanings. A lot of people flirted with Communism in the 1930s, ‘40s and ‘50s but ended up returning to their true love, Democracy. I write this as someone who had a close relative drummed out of the U.S. Army for his leftist views. He became a very successful salesman and member of our corrupt capitalist society. молодец! (Russkie for “Way to go!”)

I’m so glad I got here in time to explain the right and wrong ways to interrogate friends, lovers and employees about their immunity status.

Better: “Just conducting a little survey around the office. Did you get a headache and lose your lunch after your first or second Covid shot?”

Better: “If you think you’d prefer to die than live, remember, only one choice comes with fresh coffee in the morning. Maybe even a doughnut hole or two. I know a place.”

Wrong: “Hey, really glad that new online service Love Me Tinder dot com hooked us up! I realize I lied about my height, weight, hair color and early flirtation with the Branch Davidians. But the important thing is I used the Johnson & Johnson Baby Powder after my shower tonight, so we should be pretty safe.”

Better: “Wonderful to meet you. Does your proof-of-vaccination card look like mine? Let’s compare!”

Better: “You’re not vaccinated? Get out before I call Security.”

Ed Goldman's column appears almost every Monday, Wednesday and Friday. A former daily columnist for the Sacramento Business Journal, as well as monthly columnist for Sacramento Magazine and Comstock’s Business Magazine, he’s the author of five books, two plays and one musical (so far).

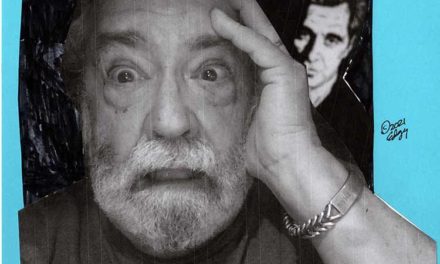

Yes, Virginia

A Weekly Blog by Virginia Varela

President and CEO, Golden Pacific Bank

photo by Phoebe Verkouw

Financial Institutions are Top Heavy with White Men

The world of banking is primarily (and traditionally) dominated at the top by white males. It just is and has been. I can’t cite all the statistical and historical reasons.

But I do strongly argue that it’s wrong and needs to change. All types of financial institutions, even the newer fintech firms, continue to be white male dominated.

According to the American Banker, women are better represented at the CEO level of credit unions than banks of comparable asset size. For U.S. banks and credit unions with between $1 billion and $5 billion of assets, 13% of credit union CEOs are women, compared to 2% for banks, according to a Credit Union National Association study.

Personally, I feel proud, honored and grateful to be a President and CEO of a federal bank and a working executive for many years in the banking industry. But I didn’t get here without strife, hard work, and the support and mentoring of other professionals—including some white men.

Some argue that change will take time, and the trends toward women in leadership positions is on the rise. Still, in banking, I work with and observe all kinds of strong and intelligent women, many stuck in lower or mid management positions, with the talents and attitude to run a company.

Let’s give them a chance.

A diverse workforce is an innovative workplace. Men and women will inevitably have different experiences and backgrounds, which shape their approaches to business. Challenging each other and collaborating with people who think differently can foster creativity, promote innovation and lead to overall greater success in pushing organizations forward.

We women represent half the human population. It’s time for financial institutions of all types to better reflect the customers they serve at all levels, including the executives at the top.

sponsored content