Email Disclaimers: Submissive Missives

Why are these things so long, so pointless and so pompous?

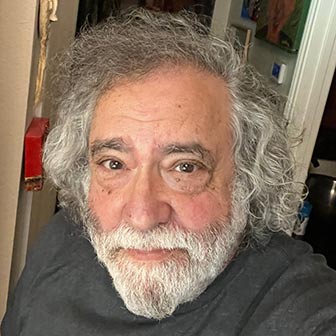

By Ed Goldman

The disclaimers on emails I get from friends in the legal, financial and real estate fields are often 10 to 20 times the length of the messages.

Here’s a genuine sampling of one of them, from a pal in the real estate business.

I’ll bcc’ing ya!

“Confidential: This electronic message and all contents contain information from [THE NAME OF MY PAL’S COMPANY] which may be privileged or confidential. The information is intended for the individual or entity named above. If you are not the intended recipient, be aware that any disclosure, copying, distribution or use of the contents of this information is prohibited. If you have received this electronic message in error, please notify the sender by reply e-mail and destroy the original message and all copies.

“Alert: For your protection and our customer’s data security, we remind you that this is an unsecured email service that is not intended for sending confidential or sensitive information. Please do not include social security numbers, account numbers, or any other personal or financial information in the content of the email when you respond.”

That’s a lot of gibberish to accompany the brief exchange of two guys planning to meet for drinks, which was about as complex as this:

ME: Wanna?

HIM: Love it!

ME: When and where?

HIM: Thursday at 4. Piatti.

ME: Done.

To be sure, most guys are pretty terse on occasions like these, possibly from an unspoken fear that if they say too much in the e-mail they’ll run out of words by the time of their get-together. I’m told this is why talk-show hosts rarely speak with their guests before airtime.

That aside, it made me wonder if other fields could benefit from pumping up the pomposity in their own communiqués. Here are some possible disclaimers for the less self-important:

- YOUR MECHANIC. Confidential: This electronic message and all contents contain information about the scheduled servicing and lube job of the recipient’s vehicle, a hybrid that runs on electricity except when it doesn’t. This email is intended for the individual named above who is herself a hybrid who works from home except when she doesn’t. If you are not the intended recipient, be aware that any disclosure, copying, distribution or use of the contents of this information is prohibited. Be also aware that we at Ralph’s Garage can offer you a smog check and completely falsify the results for an agreed-upon fee. This fee must be paid in advance if you ever want to see your catalytic converter again.

- YOUR GARDENER. Confidential: This electronic message and all contents contain information about the recipient’s weed and aphids problems which, curiously, have nothing to do with his lawn or flowerbeds. The above email prescribes that the individual or entity named above regularly consume sandwiches containing peanut butter and raspberry jam, as well as Spectracide Weed and Grass Killer Concentrate, to prevent his turning into the environmental hero Swamp Monster. Show it to anyone else but the recipient and start your lawn mower at your own risk.

- YOUR UBER DRIVER. Confidential: This electronic message and all contents contain information about the recent experience in which the recipient may or may not have noticed that the sender left what may or may not appear to be a bag perhaps brimming over with cash on the backseat of the recipient’s vehicle when the sender, seeing a police roadblock a few hundred yards ahead, bolted from said back seat and rolled down a riparian embankment to avoid a potentially embarrassing exchange with the impressively armed law officers. If the recipient of this email, who graciously “gunned it” at sender’s request upon picking him up outside a Wells Fargo branch office, would be so kind as to drop off said bag at an agreed-upon location within 24 hours, recipient will be entitled to receive probably the largest tip a driver has ever received for a 17-block fare and discretion. This email is intended for the individual named above. If you are not that individual, I don’t know what the hell you’re talking about and won’t say a word until my lawyer gets here. She may be late because she’s writing an email disclaimer.

Ed Goldman's column appears almost every Monday, Wednesday and Friday. A former daily columnist for the Sacramento Business Journal, as well as monthly columnist for Sacramento Magazine and Comstock’s Business Magazine, he’s the author of five books, two plays and one musical (so far).

Yes, Virginia

A Weekly Blog by Virginia Varela

President, Golden Pacific Bank, a Division of SoFi Bank, Inc.

photo by Phoebe Verkouw

WHAT DEPOSITS ARE FULLY INSURED? (EVERYTHING, EVERYWHERE, ALL AT ONCE)

Everyone is talking about Silicon Valley Bank this week—and will be for some time to come. It collapsed, becoming the largest bank failure since the financial crisis of 2008 and the second largest in US history.

There’s a plethora of comments about why and what happened, but as a former Federal regulator I’d like to tell you more details about something that’s important, including: (a) What is federal deposit insurance? (b) How much of my bank deposits that are in a Federal Bank are always fully covered regardless of a bank failure, and regardless of politics?

Deposit insurance is one of the significant benefits of having an account at an FDIC-insured bank—it’s what allows the FDIC to protect your money in the unlikely event of a bank failure.

The Silicon Valley Bank depositors got lucky in a way when the Fed announced last Sunday that it would fully guarantee all deposits regardless of size or ownership. It doesn’t always go that way. Fed’s are only required by law to insure deposits up to the amounts required by statutes. The standard insurance amount is $250,000 per depositor, per insured bank, for each account ownership category. But like many things published or broadcast in the media, it’s a bit more complicated than that.

What is required to be covered by statute?

The types of accounts for which deposits are covered by FDIC insurance in a federally chartered bank: checking and savings accounts; money market accounts; CDs and IRAs.

Annuities, stocks and bonds, mutual funds, securities and repos are not protected by federal deposit insurance.

Did you also know that there are times when these accounts are guaranteed to be federally insured for more than $250,000 in the same institution? How can that be?

An individual can have several accounts in one financial institution that are insured by the FDIC up to $250,000 each, provided that each account falls into a different ownership category. Federally insured accounts covered by FDIC insurance are broken out into different ownership categories, and the same individual can be insured up to $250,000 in each of these different ownership classes. As an example, some people will set up a joint account, or a revocable trust account, just to gain additional deposit insurance.

Here’s a list of the seven different ownership categories recognized by the Federal deposit insurance regs:

– Single ownership (individual);

– Joint ownership (two or more individual);

– Business accounts (corporation, partnership, unincorporated association);

– Retirement accounts

– Irrevocable trust accounts;

– Revocable living trusts (or payable upon death accounts); and

– Accounts held by government depositors

What happens to the deposit amounts of more than $250,000 in any one ownership category when an institution such as Silicon Valley Bank fails? That’s up to the Feds; it’s also up to them to prioritize payouts and timing of such.

For more information about this, I suggest you go directly to the FDIC website and search “Deposit Insurance”.

Meanwhile, rest assured: Your money is safe with Golden Pacific Bank, a division of SoFi Bank, N.A.

sponsored content