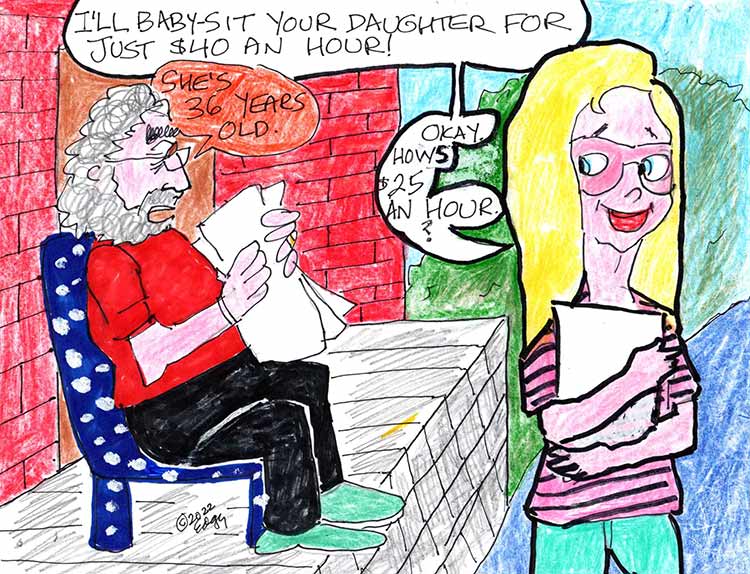

IRS Alert! Babysitters May Move Into A New Tax Bracket!

As parents head back to work, we enter a nanny state of mind

By Ed Goldman

With the parents of youngsters continuing to head back to the workplace this fall—though this time, not to a dining-room credenza or card table by the water heater in the garage—teenage babysitters are reaping the benefits. This comes from a number of news sources including, but not limited to, the Wall Street Journal, CBS News and possibly My Weekly Reader (it was difficult to read the copy I received since it was coated in Jif® Creamy Peanut Butter).

To verify this trend we decided to drop into a bargaining session between 16-year-old sitter Mia Culpa, who’ll be a sophomore this fall at Scared Heart High School (founded by an order of somewhat nervous nuns), and Cash and Carrie Diehl, the 40-something parents of twin boys Lemmie and Sacha! Diehl. (The ! is silent.)

Teen Angle

Cash works as an accountant for Proctor & Gambol, an academic testing and garden-party business, while Carrie owns a misting salon for dehydrated produce called Lettuce Spray. Both have been eager to return to their offices ever since April 2, 2020, when the country was about 72 hours into the COVID pandemic.

The session is taking place in the Diehl’s eat-in kitchen, nee home office. Mia, Cash and Carrie have their own water pitchers and glass—though Mia’s pitcher is filled with a Starbucks Reserve® Iced Hazelnut Bianco Latte, while Cash and Carrie’s pitchers contain Hornitos® 100% Pure Agave Tequila with a hint of blood orange zest. The married couple are taking notes on a shared 15-inch MacBook Pro; Mia is jotting things down on the palm of her hand and arm.

CASH DIEHL: Well, Mia, my wife and I are so grateful you decided to meet with us this afternoon.

CARRIE: We can only imagine how many parents in the neighborhood are trying to hire you now that many of us are headed back to—

MIA: Nineteen.

CASH and CARRIE: ??

MIA: That’s how many parents are trying to hire me. I didn’t want you to have to “only imagine.” Do you have, like, any scones or biscotti? And are they fresh?

CARRIE: I—No, honey, I’m sorry.

CASH: How about an English muffin?

MIA: Nah, that’s okay. (Pause) The Richardsons two doors down offered me waffles.

CARRIE (Delighted): Well, we have Eggos, Mia! Cash, go to the freezer and—

MIA: Made-from-scratch waffles, not frozen. (Making a note in her hand) You do have a waffle iron, don’t you?

CASH: I’m not sure.

CARRIE (Pointedly, to CASH): Of course you’re not! For the past two years you’ve needed GPS to find any goddamn cooking utensils. (To Mia) Yes, honey, we have a waffle iron. Would you like me to make a batch of waffles right now?

MIA: Oh, thanks anyway, Ms. D. I got pretty stuffed on waffles at the Richardsons. (Looks at her cellphone) Also, I gotta leave soon. The Ramirez family invited me over for Taco Tuesday.

CASH: But this is Monday.

MIA: They’ve offered to change the Roman calendar for me. Would you like to hear my proposal to babysit Lemmie and Sacha!?

CASH and CARRIE: Yes!

MIA (consulting some numbers on her wrist): K. I hereby agree to babysit the Diehl twins for $45 an hour plus mileage—

CARRIE: Mileage?! You live a half-block away, sweetie.

MIA (Refusing to be interrupted) —plus mileage at the current IRS rate of 56 cents per mile, or a flat car allowance—

CASH: What? No major medical? No Roth-IRA?

CARRIE: Dear—

MIA: That’s on my other arm. Are we getting close to an agreement, Mister and Missus Diehl?

CASH and CARRIE: Lord, yes! Yes, yes yes yes yes!

MIA: Great! (Rising to go) Can I come back later to get those waffles in a to-go box?

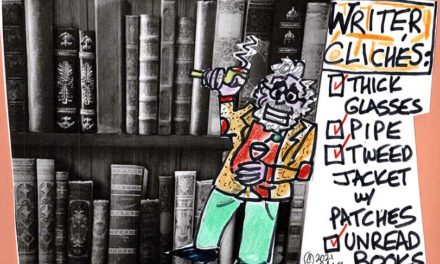

Ed Goldman's column appears almost every Monday, Wednesday and Friday. A former daily columnist for the Sacramento Business Journal, as well as monthly columnist for Sacramento Magazine and Comstock’s Business Magazine, he’s the author of five books, two plays and one musical (so far).

Yes, Virginia

A Weekly Blog by Virginia Varela

President, Golden Pacific Bank, a Division of SoFi Bank, Inc.

photo by Phoebe Verkouw

A WHOLESALE BANK THAT BELIEVES THERE’S NO PLACE LIKE HOME:

PART 1 OF A 4-PART SERIES

You may not have heard of the Federal Home Loan Bank of San Francisco but it is an important “bank for banks” that helps promote home ownership as a primary mission.

I not only embrace its values but also proudly sit on its Board as a Director.

A cooperatively owned wholesale bank, the FHLB is comprised of banks, credit unions, community development financial institutions and insurance companies, all of which share a commitment to creating opportunities within the communities they serve and changing lives for the better.

Some of its guiding principles include the following:

- It’s a reliable partner for member financial institutions of all sizes in all phases of the economic cycle;

- It represents members serving Arizona, California and Nevada;

- It supplies ready access to competitively priced liquidity, expert financial services, and resources to fuel targeted community and economic development; and

- The products, services, tools and resources it provides to its members promote homeownership, expand access to quality affordable housing, boost economic development, seed or sustain small businesses, and revitalize communities.

In addition, the FHLBank of San Francisco offers community and economic development grants. These grants are a prime example of how the organization is helping to not only expand that affordable housing access but also to fund economic development and recovery efforts.

For more info, check out their website at www.fhlbsf.com. It’s great to be a Director of an organization that provides valuable services—and values— I embrace wholeheartedly.

sponsored content