The Ugly Truth About Student Loans: Pay Them Back!

A debt-laden memoir to start your workweek

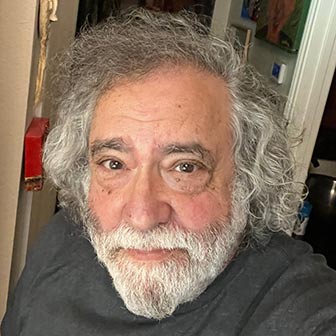

By Ed Goldman

News that Navient, one of this country’s largest lenders, has canceled student loan debt for thousands of people (eating about $1.7 billion in the process) has made me nostalgic about my own student loans—which I repaid when due. What a dork.

I took out my first student loan from the Lakewood, California branch of United California Bank, back in the day when there was a United California Bank. The deal was simplicity itself: you borrowed the dough and in five years or thereabouts, you paid it back at about 3 percent interest, regardless of what the economy was doing. The bank didn’t check to see if you spent the money on books, tuition, rent or bowling shoes. I’d say there was an honor system in place but, really, the bank just didn’t give a flying buck.

That 70s No

This was in early 1970—a few months before I began a paid internship with the Long Beach Press-Telegram, which negated my need for the loan, and two years before the vault at United California Bank’s branch in Laguna Niguel, California was famously robbed of $9 million. (That would be about $56 million in today’s currency. But check back tomorrow: it might be more like $63 million. Inflation tends to move faster than business writers.)

I think my initial loan was in the amount of $2,000 (which back then was worth about $2,000). The rent on my one-bedroom/one-bath/non-air-conditioned apartment a couple of blocks from the ocean was $125 per month. It included gas, electric, a couch, a bed, and a vinyl recliner with a huge hole in the headrest. The prior occupant, the son of my landlord, had shot himself a few months before I took the place. “I guess he just wasn’t happy,” his mom told me, both sadly and rather needlessly. She asked if it would bother me to live in an apartment where someone had taken his life. I said no but did ask if the recliner could be replaced. I was somewhat polite as a young man.

My bachelor pad also came with resident beach mice: adorable nocturnal rodents which would have eaten my leftover food but didn’t because I never had any. It’s not that I ate all that much. It’s that I couldn’t afford much more than canned lasagna, which I could buy for 47 cents a pop (which in turn worked out to about 23 cents a serving unless I fantasized I was Henry VIII and ate the entire contents of the can in one sitting).

This was my first foray into being a freelance writer and the only articles I managed to sell in those early days were articles of my clothing. Seriously. I could get $3 for a pair of Levi’s, $4 if they were tie-dyed or torn. If they were tie-dyed and torn, I might not have had to resort to taking out the student loan.

I attended journalism and English classes at Long Beach State by day and wrote at night, puffing on green Windsor cigars my Mom had bought from a smoke-shop bin marked Factory Irregulars. When I took out the student loan I immediately upgraded my cigars, paid my rent a few months in advance and stocked up on canned lasagna. The cans lining the shelves of my 1920s vegetable larder looked like a display you might find in an old-fashioned 1890s general store. Or a 1950s bomb shelter.

Well, I blew through the money in a few weeks. I was about to panic but decided to face the music and the loan counselor at United California Bank to tell her what I’d done and come up with some sort of repayment plan. Instead she handed me a check for an additional $1,000 and suggested I manage this installment a little more carefully.

I went right out and bought a 1966 excrement-brown Datsun station wagon for $450. I picked up my longtime friend, Phil Syracopoulos, so we could drive to Hollywood and have dinner at Musso Frank, where the stars dined whenever I wasn’t there. We drove north on the San Diego Freeway and were sliding onto the Harbor Freeway when flames began to shoot out from under the hood of my new car. As we laughed hysterically—our default behavior for almost any occasion, which survives to this day—I tried to steer the car onto the shoulder of the on-ramp. This is when I discovered that the steering wheel had abdicated its only responsibility and chose instead to spin around like a vertical, drunken roulette wheel.

How we survived remains a mystery, as does whatever happened to the rest of the loan money. All I can report is that I repaid it when due and was handed my first Mastercard by the loan counselor both as a reward and to ensure I’d always live my life in debt. This is why I’m hoping reincarnation works: so I can pay off all my credit cards and maybe even toss a party for the surviving beach mice. Canned lasagna will be on the menu.

Big news! Clinique is now on Amazon.

The #1 dermatologist guided skincare and makeup brand is on Amazon Premium Beauty for the first time. Shop trusted formulas across skincare, makeup, fragrance, and men’s products.

Ed Goldman's column appears almost every Monday, Wednesday and Friday. A former daily columnist for the Sacramento Business Journal, as well as monthly columnist for Sacramento Magazine and Comstock’s Business Magazine, he’s the author of five books, two plays and one musical (so far).