At Blue Line Arts, Job-Sharing Is A Creative Idea That Works

Northern California gallery is led by a dynamic duo

By Ed Goldman

Every workday, Brooke Abrames and MaryTess Mayall accomplish the near-impossible. They share the same title, office space and salary. And, defying the long odds against job sharing being successful, they’ve made it work for nearly four years.

The two are co-executive directors of Blue Line Arts, an art-forward gallery in the downtown district of a decidedly conservative city, Roseville—about a 20-minute drive yet political lightyears away from California’s capital.

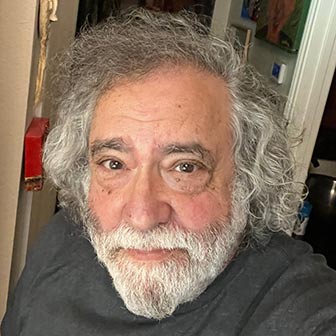

Mayall and Abrames: photo by Ieshai Radonga

As defined less condescendingly (or gender-specifically) by Duke University, job-sharing is an “arrangement (which) is a full-time job split between two individuals, each with responsibility for the success of the total job. Job sharing allows two staff members to share the responsibilities of one full-time position, typically with prorated salary and paid time off.”

Both Abrames and Mayall are in their early 30s, which I mention only because they admit that when they proposed their work arrangement to Blue Line’s board of directors, “We both knew we had a lot to learn,” says Abrames.

“But we’re both hard workers and we already got along working together at the gallery,” Mayall says. Abrames had been a development associate and Mayall a program coordinator for Blue Line. Today, they each do almost everything affiliated with running a nonprofit art gallery—there are only two additional staff members—though they say they separate some of the tasks to play to their individual strengths.

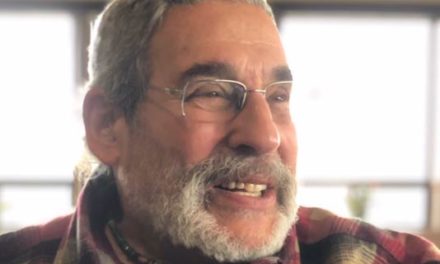

Peter Combe’s swatch portrait of Marilyn Monroe: photo by Brian Wilk

“It’s kind of murky sometimes about who does what because we’re both pretty good at it,” Abrames says. “But since I was in development and fundraising, more of that probably falls my way and MaryTess does more of the educational programs and some of the day-to-day administrative things, while I do the payroll.”

But they both plan the shows (the one up now is phenomenal, which I’ll discuss in a moment). They’ve also not only convinced directors of the prestigious Crocker-Kingsley exhibit, a juried every-other-year show open to artists around the globe that Blue Line was hosting long before Abrames and Mayall came on the scene, but also have added one of them to the gallery’s board of directors.

I should disclose here that I’m a former board member and was president of Blue Line Arts for two years, though my only affiliation with it these days, nearly a decade later, is to view and buy art there.

For instance, one of the gallery’s current shows (through January 8) features the dazzling work of San Francisco-based artist Peter Combe, who cuts up paint swatches or vinyl paillettes (better known as spangles) to create what appear to be 3-D portraits of celebrities. It’s a very modern take on what the French call trompe l’oeil (fools the eye) and that some still refer to as op-art. Either way the pieces, while pricey, are well worth an in-person or online visit. (As an example of Abrames and Mayall’s vision, Blue Line added e-commerce to its website even before COVID-19 forced brick-and-mortar retailers to do so in order to survive.)

One of the gallery’s more crowd-pleasing events, which started before my own reign of error, is called Lottery for the Arts, the next one being January 27th. A fundraiser for Blue Line’s educational programs, it’s a funny evening (5:30-8 p.m.) that guarantees participants go home with an original work of art. You can attend in the flesh, by phone or from your computer. If you do, it’ll make the gallery’s management co-happy.

Ed Goldman's column appears almost every Monday, Wednesday and Friday. A former daily columnist for the Sacramento Business Journal, as well as monthly columnist for Sacramento Magazine and Comstock’s Business Magazine, he’s the author of five books, two plays and one musical (so far).

Yes, Virginia

A Weekly Blog by Virginia Varela

President and CEO, Golden Pacific Bank

photo by Phoebe Verkouw

Did you know that US Banks play an important supporting role in providing additional funding and services at times of disaster? Yup! With every recent nationally declared disaster, community banks have been there to provide desperately needed community support.

This week, our hearts go out to the state of Kentucky and the surrounding states affected after severe storms, straight-line winds, flooding and tornadoes. President Biden issued an emergency declaration for Kentucky—and bankers got right on it to assist with the recovery efforts.

Years ago I was a member of an interagency task force of federal and state bank regulators that assisted those affected by one of the worst disasters of its time, Hurricane Katrina. I was impressed back then, and continue to be, by the prompt and generous responsiveness of bankers to assist the communities they serve.

Community banks provided financial counselling services, temporary installment loans, grants, and cash deposit services. There was a particular emphasis on helping those in the greatest financial need in worst-hit areas, with a particular emphasis on making sure minority groups were taken care of.

There has been an acceleration in the number of disasters and their associated costs over the past century. Wildfires, floods, and hurricanes can cause severe property damage in the affected communities. Typically, insurance policies and government disaster relief fail to cover the full amount of damages. In this case, banks play an important supporting role in providing additional funding for the necessary reconstruction that takes place after disasters.

At the same time, banks increase the use of cash and deposit flow after natural disasters to particularly help individuals and small businesses in affected communities. Banks located in the disaster-prone areas contribute to helping communities recover from natural disasters.

Banks are known for helping people save money. Sometimes, we also help save people’s lives and futures.

sponsored content