Bad Hires Cost Companies Time, Money and Anxiety

A national trend of wrong or delayed decision-making

By Ed Goldman

Companies can waste a great deal of time and money—and doubtless, staples, paperclips and Ticonderoga Number 2 pencils—making bad hires.

A new survey by the Robert Half firm, which is a whole company, despite its name—in fact, it’s the largest specialized-staffing firm in the Milky Way, according to authorities familiar with things like that—reports that 67 percent of senior managers here in California’s capital have been recruiting the wrong candidates for specific jobs.

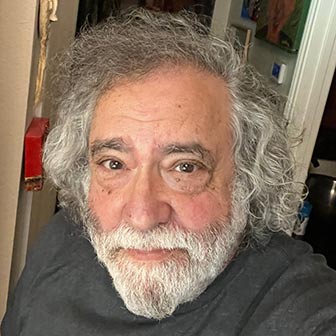

Kim Dukes photo by Robert Half Agency

“It’s a serious problem,” Dukes tells me without even having read my previous parenthetical aside. She cites “four fairly common mistakes” that companies make when they hire people. “Not having a well-written job description can start everything off on the wrong foot,” she says. “A second mistake is focusing too much on how someone may not fit in a business’s culture. The fit is important when you have two equally qualified candidates, and one just gets along better with people, has more of a personality and so forth. But to stress the fit alone can deny a company diversity and variety in its work force.”

Finally, Dukes mentions perhaps the fourth and possibly biggest mistake of all: “Taking too long to make a decision. In this market, if you interview someone on a Monday, then don’t contact them ‘til Friday, they’ll probably have taken another job in the meantime.”

Dukes believes that “the tighter the hiring process, the better chance you have of getting the right person. Do you know that expression, ‘Time kills all deals’? It really is true sometimes.”

At 42, Dukes has worked her way up through the Half firm, which she first joined 11 years ago in its San Jose office. She and her husband, Darrin, who works in the medical equipment industry, have an 18-minth-old son, Tristan James. I confess I love the little guy’s name and ask Dukes what sort of nickname may be affixed to him as he grows up: Tris? Tristy? Stan?” She says her son’s initials, T.J., will probably be the top choice.

I think about that and agree. T.J. Dukes sounds like someone you’d better not mess with—and someday, that will include not making him wait until Friday to learn you wanted to hire him five days ago. Guys named T.J. simply have no time for that kind of nonsense.

Ed Goldman's column appears almost every Monday, Wednesday and Friday. A former daily columnist for the Sacramento Business Journal, as well as monthly columnist for Sacramento Magazine and Comstock’s Business Magazine, he’s the author of five books, two plays and one musical (so far).

Yes, Virginia

A Weekly Blog by Virginia Varela

President and CEO, Golden Pacific Bank

photo by Phoebe Verkouw

I’m proud to be a Director of the Federal Home Loan Bank of San Francisco (Bank)—and prouder still to chair the Affordable Housing Committee of that board.

The Bank offers valuable community programs that most folks are not even aware of. For example:

-The Bank’s grant and discounted-credit programs are designed to support affordable housing and economic development activities that make a difference in the cities, towns and neighborhoods they serve;

-Its affordable housing program (“AHP”), which was created in 1990, has awarded more than $1.1 billion to help nearly 146,000 households have an affordable place to live;

-The Bank’s first time homebuyer programs offer lower income families and individual grants of up to $22,000 that they can use for down-payment and closing costs, because homeownership offers an opportunity to build wealth;

-The Bank’s economic development grants (delivered through members such as Golden Pacific Bank), help nonprofits create innovative jobs programs or delivery vital educational and social series in underserved communities; and

-The Bank also offers discounted credit for housing and economic development. Members use these low-cost credit programs to help finance affordable housing, economic development, and community revitalization activities.

In short, what a marvelous organization—and what a wonderful opportunity to serve our communities. I think you can see why I’m proud.

sponsored content