Andrew Rogerson’s Clients Value His Valuations

The California-based business consultant helps sell and buy companies

By Ed Goldman

This past March, just as the world was beginning its pandemic shutdown, Andrew Rogerson still was able to help one of his clients sell a medical-supply manufacturing business for $3.1 million.

“I get a success fee when that happens,” he says. And if the company wouldn’t have sold despite Rogerson’s best efforts? “Oh sometimes I get a thank-you note,” he says in his deadpan, Aussie accent, which somehow can make a situation sound funny rather than frustrating.

For the past 15 years, Rogerson, who’s 64, has been helping clients sell a variety of California businesses—as well as advise them on how to do valuations on companies and equipment, invest in franchises, buy companies and execute a diversity of tactical moves in the industry sector. What he provides through his firm, Rogerson Business Services, are pretty much one-off transactions—meaning, that while he gets plenty of referrals from satisfied customers, he rarely gets repeat business.

“They sell their company, they’re done with me,” he says in a tone that may define the word chipper. “And that’s just fine.”

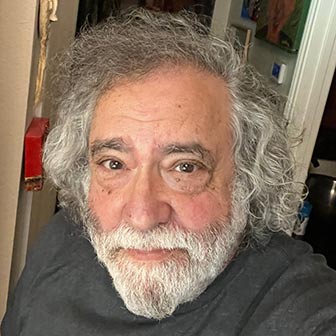

Andrew Rogerson photo by Nick Kalfountzos

I first wrote about Rogerson seven years ago, for the Sacramento Business Journal. At the time, he told me his Down Under back-story—how, when he was 21 years old, his grandfather gave him $10,000, which Rogerson used to build a house in his native Melbourne. “My dad was a plumber,” he said, “and everybody pitched in.”

Rogerson still believes in collaboration, many homes and five businesses later—including his ownership of an executive-suites complex, an office equipment business and both retail and wholesale travel agencies (one of which he says he sold for “240 percent of the original purchase price” just before that industry was largely rendered obsolete by the Internet). To help a client sell or buy a business he might bring in attorneys, accountants and an escrow company. In California, buying a business especially becomes a multi-player transaction. That’s collaboration.

Although Rogerson loves his work and can’t imagine retiring, he admits that one tragic result of his success still bothers him. He helped an entrepreneur sell a business he’d owned for many years “and he identified himself with it so much that once it was gone, he couldn’t find anything to replace its meaning for him and committed suicide.”

I ask Rogerson why he prefers to limit his territory to California when his skills and contacts could easily plunk him down in other less regulatory states, or even his birthplace. “Australia is much more regulated than the U.S.,” he says with a smile. “And look at New Zealand. Everyone wonders how they kept Covid under control there. It’s simple. The government just said, ‘Here’s how it’s going to be and you’d better comply.’ And the people did.” Also, he says, business rules “are different in each state. So if someone in another state were to see this article and contact me about helping him do a transaction where he lives, I’d probably refer him to someone I know there.”

“The same day as my birthday,” Rogerson says. “You can’t get much better than that.” Watching his face crease into a grin, I realize Rogerson knows there are different kinds of success fees.

Ed Goldman's column appears almost every Monday, Wednesday and Friday. A former daily columnist for the Sacramento Business Journal, as well as monthly columnist for Sacramento Magazine and Comstock’s Business Magazine, he’s the author of five books, two plays and one musical (so far).