Golden Pacific Bank is Helping Small-Business Owners Navigate Rough Seas

CEO Virginia Varela, an acknowledged turnaround expert, is at the helm

By Ed Goldman

Varela’s ship is Golden Pacific Bank, where she’s been president and chief executive officer for seven years. The war zone she and her team are navigating is the sea of shoals and icebergs caused by the corona virus, threatening the economic floatability of small businesses, which Golden Pacific specializes in.

“All of the country’s banks, big and small, are worried about the rescue packages being put together by the federal government,” she says. “They sound attractive but they’re not being issued with critical guidance or guarantees, which is really making the big banks hesitate.

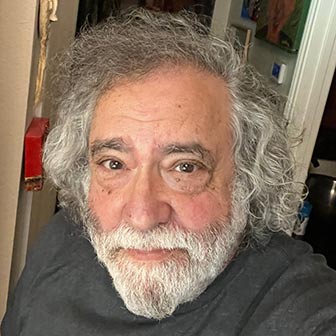

Photo by Gordon Lazzarone of Lazzarone Photography.

“For instance, the Small Business Administration (SBA) paycheck protection program allows small businesses to obtain what almost sounds like a grant to allow them to keep operating.” What the big banks are saying—the references Bank of America, JP Morgan/Chase— is that until the federal government puts it in writing “and tells the banks specific terms on how the program will work, it may be too much of a risk.”

Varela has opened an email hotline at Golden Pacific for borrowers, Covid19@goldenpacificbank.com, and says that while she and her staff are moving “quickly and nimbly to respond,” she says that they’re also making sure “every ‘i’ is dotted and every ‘t’ is crossed. We don’t want requests bouncing back when timing is so important to our customers, their employees and their employees’ families. And we’re afraid that some banks are rushing into things, which is never a good idea when the needs are so great and the stakes are so high.”

Golden Pacific has three branches—its headquarters in Sacramento’s midtown area and two in the Sutter/Yuba region. They remain open as what the government calls “essential businesses.” “We’re rotating the employees so that they put in time at the bank and also work from home,” she says.

While her bank does its fair share of SBA loans, Varela has high hopes for the state-run, California Infrastructure Economic Development Bank (IBank). “We’re working with those folks and doing very tailored programs for our customers,” she says. “We may be all in this together but when it comes to a company’s needs, one size definitely does not fit all.”

For much of her career in the financial services industry, Varela was known as a turnaround expert, which is what she did with Golden Pacific, which was beginning to tread water as a residential bank before her arrival. Having run four banks and served as a banking regulator, she thought that Golden Pacific could do much better as a business bank focusing on community firms. One of the first women in the United States to work as a banking examiner for the U.S. Treasury Department, she also did stints at the Federal Reserve Bank and the Federal Home Loan Bank.

Her A Team at Golden Pacific includes: Malcolm “Mac” Hotchkiss, chief operating officer, who had recently been the CEO of Community Business Bank in Oakland (and also happens to be Varela’s husband of 14 years); Joseph McClure, chief business officer, who spent more than a quarter century in small business lending and economic development; Christine Whitney Luty, chief credit officer; and Matt Klinker, chief financial officer. All are executive vice presidents of the bank.

Ed Goldman's column appears almost every Monday, Wednesday and Friday. A former daily columnist for the Sacramento Business Journal, as well as monthly columnist for Sacramento Magazine and Comstock’s Business Magazine, he’s the author of five books, two plays and one musical (so far).